We're still hanging in there with our budgeting system and it's been working wonders for us. I'm really proud of how much we've managed to sock away since we started three years ago and it made all the difference in the world when our car died unexpectedly last May (which meant purchasing TWO cars in one year, because we knew we were going to have to get a second car when we moved to our new place). Of course, it's really easy to get discouraged when I realize that odds are we will never, ever, be able to buy a house in LA no matter how disciplined we are. Note to self - remember to purchase a lottery ticket.

The money cards that I designed worked for us pretty well for a couple years but I've gotten so lazy with them over the last year. Instead of actually checking off as we go along I've been diving into our bank account and credit card statements twice a month and manually sorting things into categories to figure out where we stand. Not only is this time consuming (why I procrastinate on the cards lately is beyond me, because it would be easier in the long run) but it means it's harder to us to keep ourselves in check during the month. If I'm not seeing where we stand every time I enter an expense, it's much easier to accidentally blow past our limit.

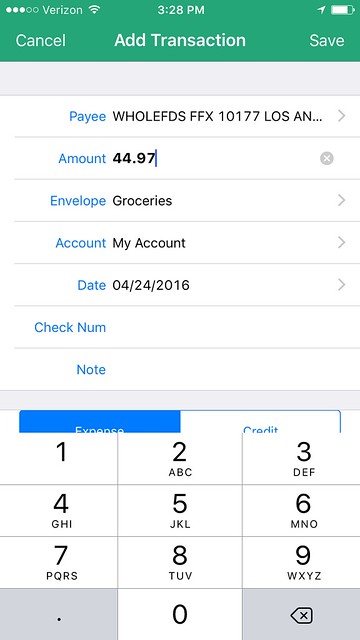

So I went hunting for an app that would work for us and I found Good Budget. It's designed around the concept of cash envelopes, which makes it perfect for the allowance system I use. I can set up envelopes for each of our categories and set them to fill up at the beginning of each month. Each time we make a purchase, it's easy to open the app and add the transaction in the right category.

I have a couple "envelopes" that aren't really monthly. Circe gets $100/month, but we usually only use $15 for food and then let the rest rollover until we have a vet visit or a prescription refill or something. I track it in the app because I reimburse our checking account from her savings account at the end of each month (or when I remember).

It does not link directly to your accounts! I prefer this, although it means we have to enter everything on our own. I only track spending in certain categories anyways, and I feel safer not giving an app access to all my accounts (note - I have never heard any bad stories about Mint or other apps that link directly and I know people who have happily used them for years now. I'm just more comfortable not linking!). To get us caught up when we started I did download Quicken files from our bank and upload them on the Good Budget web interface. It was really easy to run through and quickly categorize our transactions that way, although since then we've just entered everything in real time on our phones.

It has way more options than I've explored fully. I'm using the free version, which is perfectly adequate for our needs. You get up to 20 envelopes and you can register two phones (plus log in to the web interface from wherever). That's all we need for now, although I'm tempted to try doing our entire budget through Good Budget because it would be fun to see all the data. As I've mentioned, I don't track most of our set spending categories. I usually do a general financial check every couple months and check on the balances in all our various accounts. It might be nice to be able to see all that in Good Budget, but I'm not sure if it's necessary.

The only thing that isn't ideal for us is that we're sharing everything. You basically set up a household and then everyone logs in using the same information. We aren't secretive about our finances, but one of our mainstays is that we each have a monthly allowance and how we spend it is entirely up to us. In this system, I set up envelopes for each of us with our allowance and we manage them ourselves, but if we're looking at the most recent transactions list, you will see what the other person is spending. This isn't a huge deal for us and the only time I can see it being an issue is when we're purchasing gifts for each other. We'd have to remember to enter those transactions later to avoid spoiling any surprises. It would be nice to have profiles within a household, so that you can have shared envelopes and individual envelopes.

I'm still using this basic budgeting system and I've mostly resisted the temptation to increase any of our discretionary categories over the last couple years, although last month I finally decided to give us an extra $50/month for groceries. I figure the longer we can keep living at our current level (which is a cut above grad school spending, but still fairly low for our area/age), the better off we are.

All of my extremely wordy budgeting posts here.

What it looks like when you enter an expense. You just choose the envelope you want the money to come out of, where you spent it and how much. I love that there is a note section at the bottom, so I can enter quick notes to myself if I need to. I don't enter notes for every transaction, but it's nice for the ones that can be vague (i.e. I more or less know what I bought at Trader Joe's, but Amazon and Target could be almost anything). You can also choose to split between envelopes, which I looooove and use a lot (particularly at Costco, where we buy both groceries and household supplies).

I've been using an excel spreadsheet similar to yours for years but we recently decided to really buckle down to pay off some debt and made the jump to You Need a Budget (which sounds similar to what you're using except linked to accounts). I have our monthly budget and then another budget set up for our "sinking funds" (Dave Ramsey follower here!) and I am loving it. Before I was always the driver of the budget so my husband would have to check in before spending larger amounts of money. Now he just has to bring up the app and he can instantly see how much is left in the bucket. It's been really nice not being the gatekeeper of our money!

ReplyDeleteI've heard great things about YNAB! And I agree with you on the gatekeeper issue - D is always on board with budgeting but I feel like a killjoy if I'm the one checking balances to make sure an expense is okay. So much easier if we can both pull it up on our phones and know it's updated in real time!

DeleteJessica--I just asked Rachel too, but what books would you recommend for someone interested in learning more about personal finance? Which David Ramsey book is most useful?

DeleteI actually haven't read Dave Ramsey's book, but I basically read everything I could online (I just googled Dave Ramsey baby steps to start off, and then Dave Ramsey _______ when seeking specific info about specific things), and also belong to a "We're Debt Free" board and the people on there are extremely knowledgeable (if at certain times a bit too tough love for me).

DeleteWhat two or three books would you recommend for someone interested in learning more about personal finance? In your last post you mentioned "Smart Women Finish Rich." I'd like to learn more but I don't have enough experience to judge which books are truly useful.

ReplyDeleteHi, Yulia! Smart Women Finish Rich and Smart Couples Finish Rich are really great starting points, in my opinion. I know many, many people who have had great success with the Dave Ramsay system, but I haven't read any of his books, so I can't speak to it. I haven't read Suze Orman's books either, but she is a huge name and lots of people like her.

DeleteThere are also tons of great personal finance blogs out there! I used to be a daily reader of "Get Rich Slowly" - the original owner sold it a few years ago, so I'm not sure of the quality now, but the archives will have lots of good info. "The Simple Dollar" has lots of frugality tips (I don't really go whole hog on frugality, but I know it's really helpful for some) and "Mr. Money Mustache" is all about early retirement.

I tend to google financial things when I have a question and those PF blogs tend to pop up a lot. The comments sections can be as useful as the blog posts! I try to keep an eye out for sponsored posts, though. Some of the PF blogs accept sponsorship from various credit cards, mutual funds, etc. and although they are pretty good about stating it clearly, I think it's really important to know when you are reading a sponsored post about financial advice!

Hi Rachel,

ReplyDeleteQuick question, and I feel like the answer may seem really obvious but I just wanted to confirm. I've downloaded your budgeting spreadsheet (thank you so much for making it available!) and i'm wondering whether you copy and paste the same page for each month? So you end up with JAN, FEB, MARCH, APRIL along the bottom?

Thanks in advance!!

Gaby

Hi, Gaby! I am a pretty lazy budgeter and I don't track like this, but you certainly could! I only use the budget spreadsheet when I'm figuring out a new budget for us (at least once per year, but also anytime our salaries or expenses change). I use the spreadsheet to figure out what we can afford to spend/save in each category. Then it's set and I don't mess with the spreadsheet again. Instead, I track our spending in certain categories using either GoodBudget (currently) or by hand with budgeting cards for each month (posted on the blog in the past).

DeleteA more specific monthly budget is probably useful if your income and/or expenses vary by month, or if you want to use the spreadsheet to keep track of your actual spending in each of your categories.

Hi Rachel,

ReplyDeleteThanks for sharing your experience! I’ve never heard about Good Budget app. Each month I promise myself to start maintaining my family budget in order to save some money for our next vacation. Luckily, I’ve accidentally found your useful notes ;)